Example: Loan Pools

The loan origination process is an essential aspect of the financial sector, and it has always been a challenge to track the origin, history, and ownership of loans. With the advent of blockchain technology, this process is undergoing a transformation. The Provenance Blockchain is one such platform that has leveraged blockchain technology to revolutionize the loan origination, structuring, and trading process.

Loan Origination and NFTs

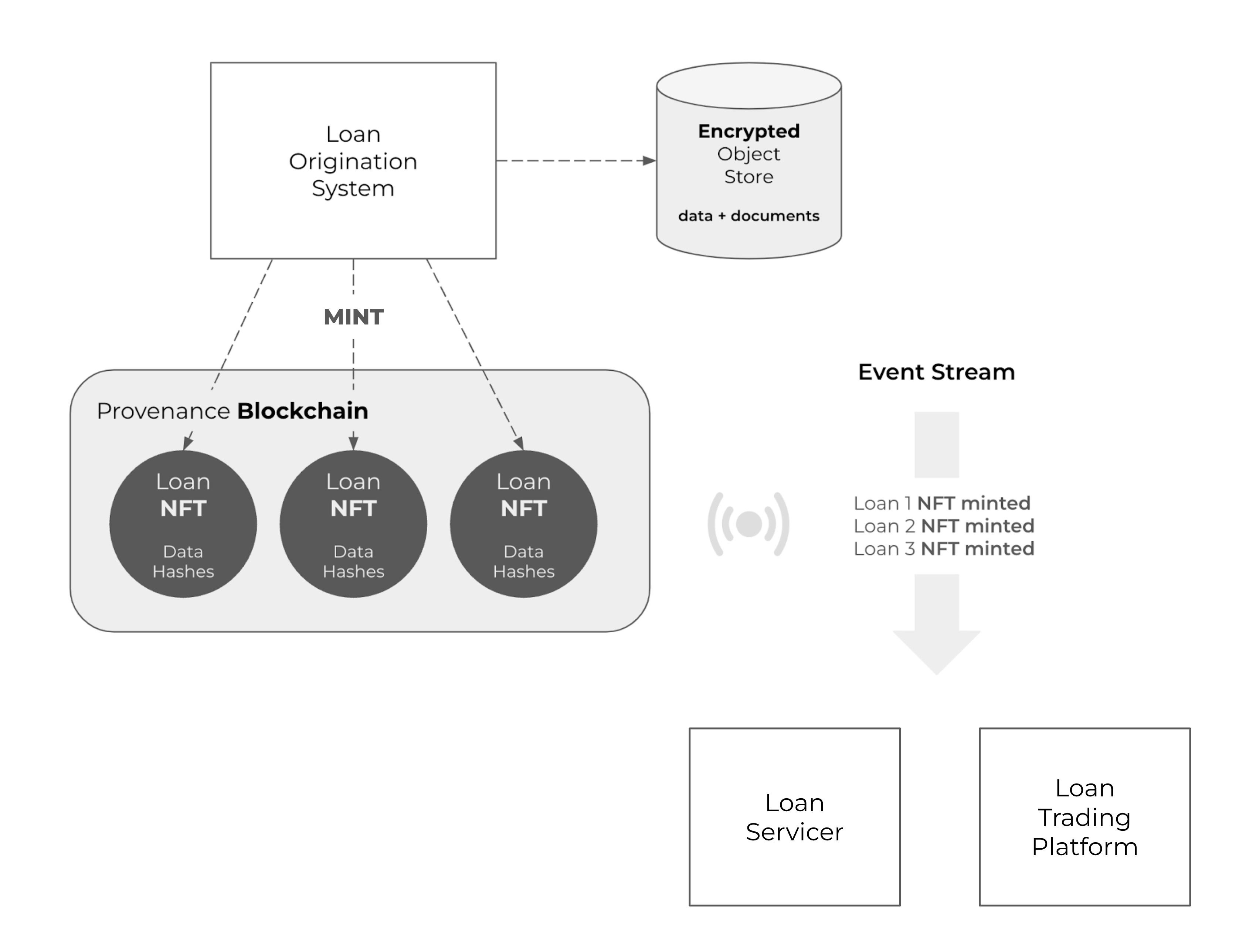

When a loan is issued by an originator, the Loan Origination System (LOS) mints a Non-Fungible Token (NFT) that represents the loan on the Provenance Blockchain. The NFT is a unique digital asset that represents ownership of the loan and serves as a digital certificate of ownership.

Data Privacy and Encrypted Object Store (EOS)

In the Provenance Blockchain, loan-level data and related Personally Identifiable Information (PII) is kept off the blockchain in the Encrypted Object Store (EOS). This includes all the documents generated for the loan, such as loan applications, borrower information, and loan agreements. By keeping this sensitive data off the blockchain and coordinating it with the NFT through data hashes, Provenance Blockchain ensures the privacy and security of the loan data.

The loan originator can choose to grant read or write permission to the data in the EOS to other participants, such as the loan servicer or a loan trading platform. This enables these participants to access the loan data in the EOS, provided they have the necessary permissions.

Event Stream and Continuous Notification of Loan Onboarding

When any NFT is minted on the Provenance Blockchain, a notification of NFT creation goes out as an Event. This continuous sequence of events is called the Event Stream. The Event Stream enables other decentralized applications (dApps) or systems to listen to the stream and hear when a new loan NFT is minted.

Provided they are permissioned to read the data, downstream systems can fetch and decrypt loan-level data from the EOS. This enables real-time monitoring and analysis of the loan data, and provides a transparent and auditable record of all activity related to the loan.

Loan Pools and Markers

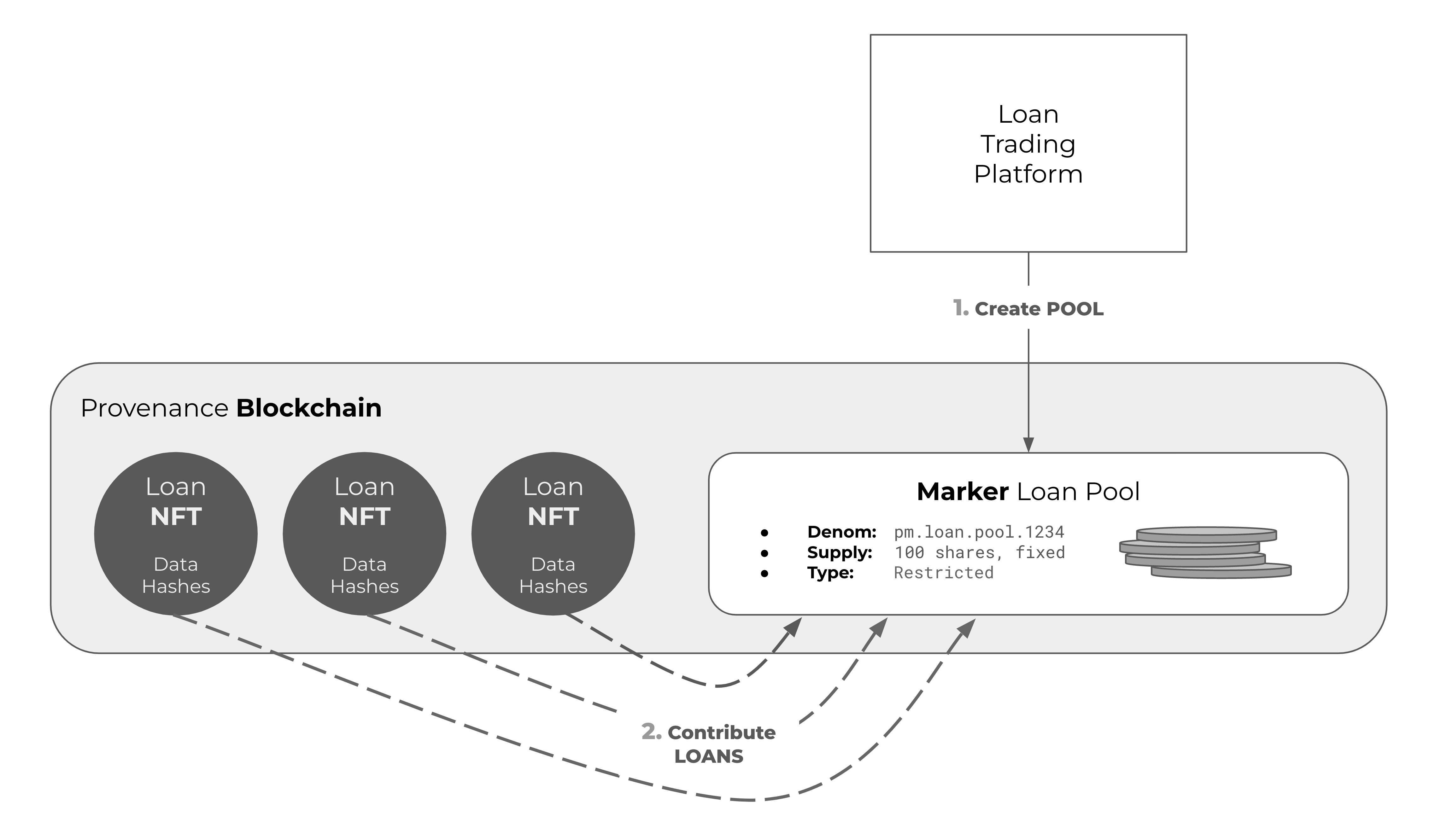

Loan Pools allow for the bundling of individual loans into a single, more easily tradable security. This provides a means for pooling risk and increasing liquidity for investors. The Provenance Blockchain provides a flexible solution for creating these loan pools by using its Marker construct.

A loan trading platform dApp can be used to select loans for contribution to a pool and create a Marker. The loan-level data is stored in the EOS and can be permissioned to the loan trading platform, giving them access to the data necessary to make informed decisions on loan selection.

Each Marker has a token representing ownership in the pool, with a specific name or denomination that is unique to the pool. The supply of shares in the token can be fixed at creation, or it can be floating, with the number of shares changing based on investor participation in the pool.

In the case of a Restricted Marker, the trading of shares in the loan pool is controlled by the loan originator and the trading platform. This ensures that the loans are managed in a manner consistent with the intended use of the loan pool. For example, for a loan pool representing a whole loan sale, the supply of tokens may be set to one share, indicating the sale of the entire pool of loans to a single investor.

The Provenance Blockchain provides the ability to create multiple types of loan structures, making it a powerful platform for managing loan assets. By using NFTs to represent loans and Markers to represent pools, a wide range of loan pool structures can be created, including Mortgage-Backed Securities (MBS), Loan Participations, and Residential, Commercial, and Consumer Whole Loan Pools. The creation of loan pools through the use of Markers provides a means of pooling risk, increasing liquidity, and making loans more easily tradable, making it an attractive platform for loan originators, loan servicers, and investors.

Tracking Total Value Locked (TVL) for Loan Pools

Total Value Locked (TVL) is a critical metric for assessing the overall health and success of a DeFi protocol. In the context of Provenance Blockchain, TVL includes the amount of capital that has been invested into loan pools.

The TVL for loan pools on Provenance Blockchain is determined by the originator's Capital Markets team. The team evaluates a variety of factors such as unpaid balances, accrued interest, market trends and potential loan movement between pools to price each marker loan pool. The pricing is updated on a daily basis.